In an announcement that has stirred considerable debate, Luxembourg is preparing to impose new taxes on e-cigarettes and nicotine pouches, starting from October 1, 2024. According to the Ministers of Health, Martine Deprez, and Finance, Gilles Roth, who responded to an inquiry by MP Sven Clement of the Pirate Party, the proposed taxation will see e-liquids taxed at €120 per liter and nicotine pouches at €22 per kilogram. This move is part of a broader national anti-smoking program that aims to encompass these new-generation tobacco products.

At Considerate Pouchers, we find this approach not only counterintuitive but also potentially detrimental to public health efforts aimed at smoking cessation. Here’s why.

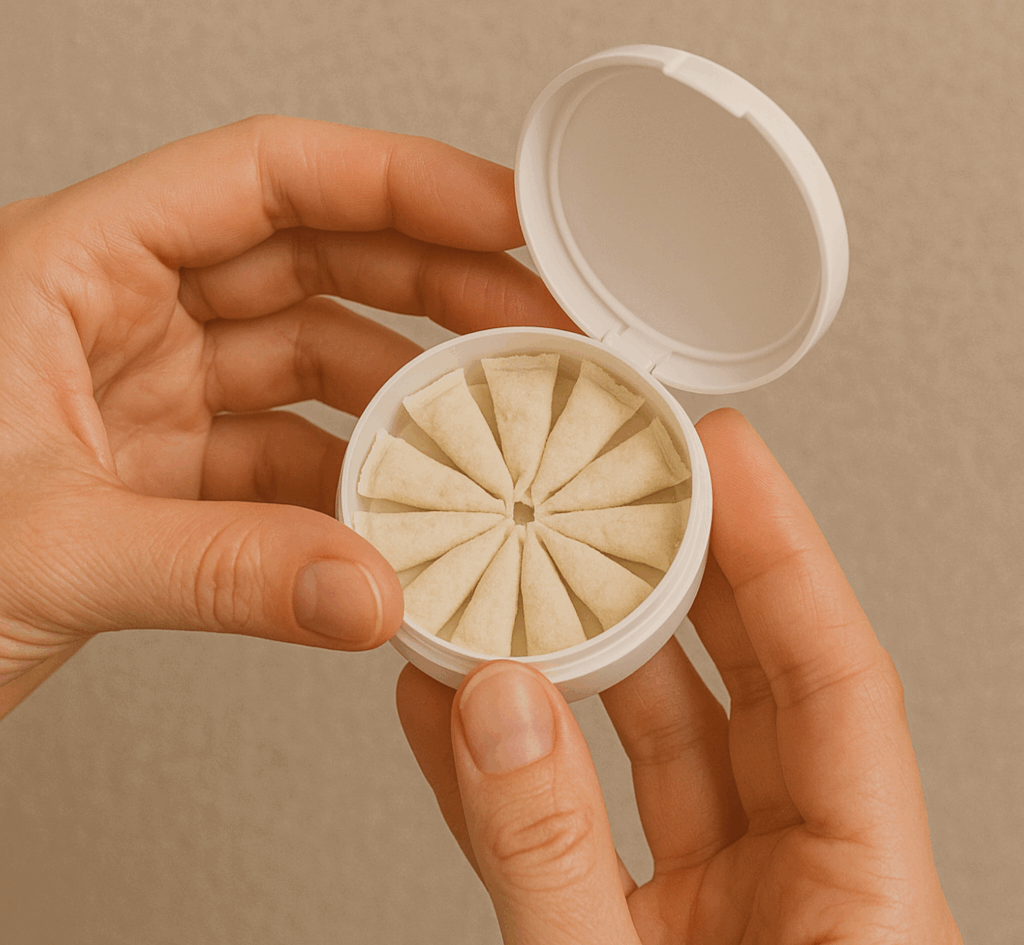

The Safer Alternatives

Firstly, it is widely recognized in the scientific community that e-cigarettes and nicotine pouches are less harmful than traditional cigarettes. Public Health England, for instance, has consistently reported that vaping is 95% less harmful than smoking tobacco. Nicotine pouches, similarly, offer a smoke-free alternative, providing nicotine without the tar, carbon monoxide, and other harmful chemicals found in cigarettes.

Economic Implications of Higher Taxes

The decision to levy such steep taxes on these products is aimed at reducing their consumption. However, this policy fails to consider that many smokers have turned to these alternatives as a means to quit smoking. By making these products more expensive, the government is not only penalizing individuals who are trying to reduce their health risks but also inadvertently discouraging smokers from making a switch to these safer alternatives. The financial barrier created by higher taxes could compel many to continue smoking traditional cigarettes, which remain cheaper and more harmful.

Consumer Impact and Smoking Cessation

The impact on consumers is clear: higher prices will make it more challenging for smokers to access these safer alternatives. In a time when public health should be a paramount concern, it is crucial to encourage, not hinder, the adoption of harm-reduction tools. The new tax regime could reverse the progress made in smoking cessation efforts by making less harmful products less accessible and affordable.

A Contradictory Approach to Public Health

Furthermore, this policy seems to contradict the very essence of public health promotion. While the intent of Luxembourg’s anti-smoking program is to reduce smoking rates, the inclusion of safer nicotine products under punitive tax measures sends mixed signals. If the ultimate goal is to improve public health, policies should be aligned to support the adoption of less harmful alternatives rather than lumping them together with more dangerous traditional tobacco products.

At Considerate Poachers, we urge a reevaluation of this policy. A more balanced approach would consider the role of e-cigarettes and nicotine pouches in smoking cessation. Rather than imposing prohibitive taxes, the government should focus on regulating these products to ensure safety and efficacy while keeping them financially accessible to those who need them most.

This policy may inadvertently undermine public health goals and perpetuate the very issue it seeks to resolve. We believe in promoting health without penalizing those who are trying to make better choices for themselves.